Business Insurance in and around Philadelphia

One of Philadelphia’s top choices for small business insurance.

Cover all the bases for your small business

Help Protect Your Business With State Farm.

Operating your small business takes hard work, time, and great insurance. That's why State Farm offers coverage options like a surety or fidelity bond, errors and omissions liability, extra liability coverage, and more!

One of Philadelphia’s top choices for small business insurance.

Cover all the bases for your small business

Insurance Designed For Small Business

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Brian Cover for a policy that safeguards your business. Your coverage can include everything from worker's compensation for your employees or a surety or fidelity bond to professional liability insurance or key employee insurance.

Call or email agent Brian Cover to consider your small business coverage options today.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

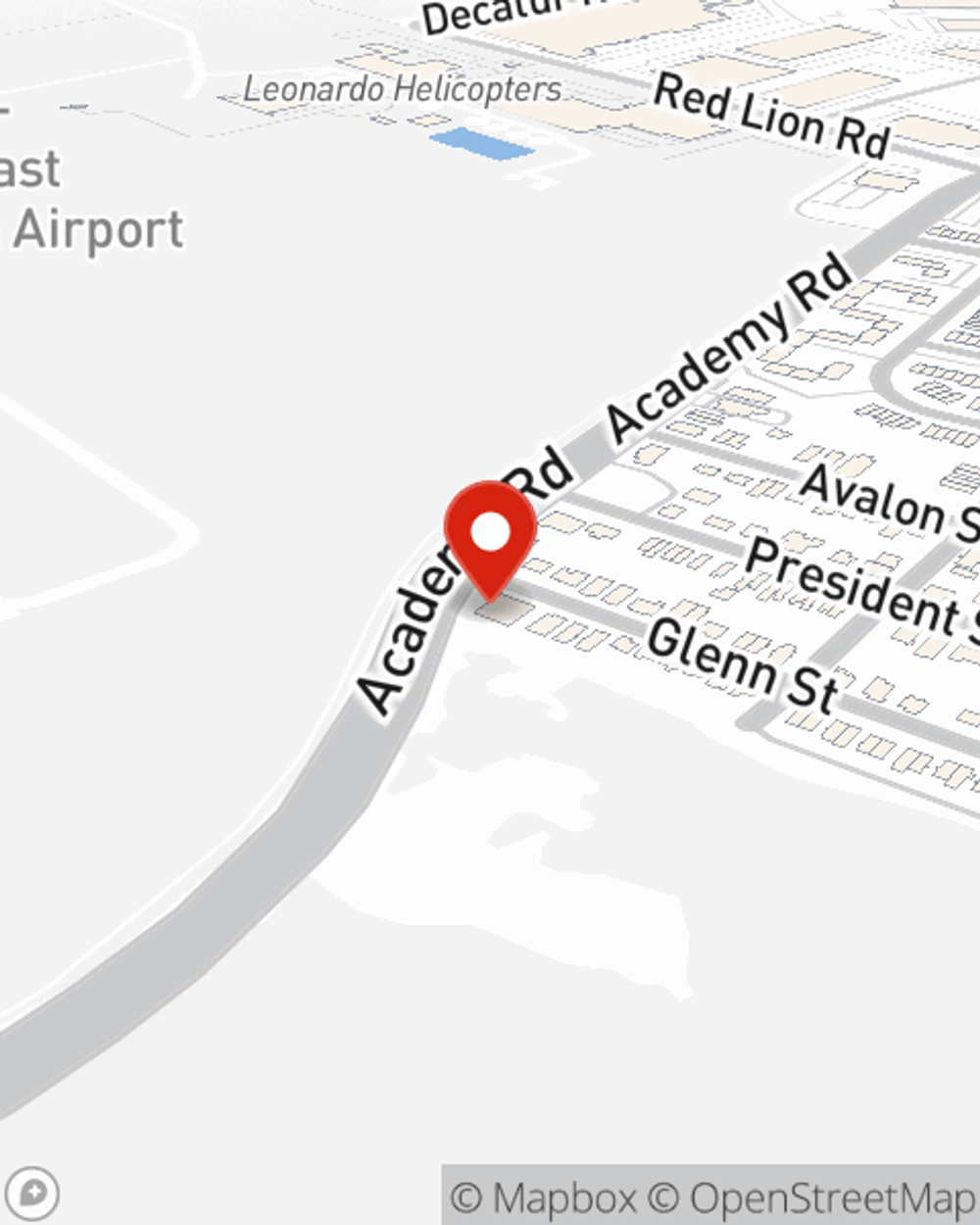

Brian Cover

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.