Renters Insurance in and around Philadelphia

Your renters insurance search is over, Philadelphia

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Think about all the stuff you own, from your dresser to desk to bedding to books. It adds up! These belongings could need protection too. For renters insurance with State Farm, you've come to the right place.

Your renters insurance search is over, Philadelphia

Your belongings say p-lease and thank you to renters insurance

Why Renters In Philadelphia Choose State Farm

Renting a home is the right choice for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance could cover the cost of damage to the structure of your rented home, but that won't help you replace your possessions. Renters insurance helps shield your personal possessions in case of the unexpected.

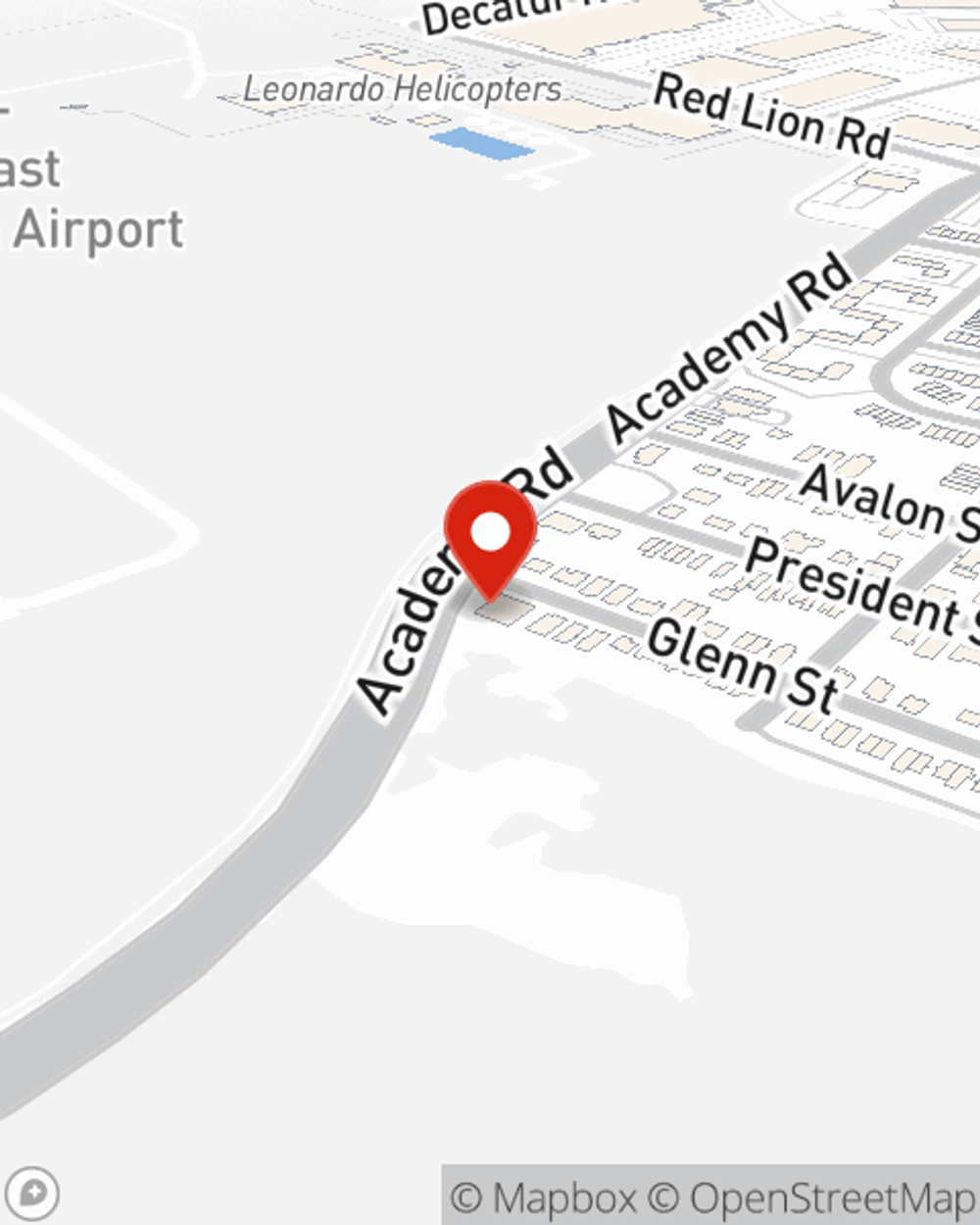

More renters choose State Farm® for their renters insurance over any other insurer. Philadelphia renters, are you ready to talk about the advantages of choosing State Farm? Get in touch with State Farm Agent Brian Cover today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Brian at (215) 632-7000 or visit our FAQ page.

Simple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Brian Cover

State Farm® Insurance AgentSimple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.